Understanding Tax Filing for Corporations and LLCs in the U.S.: Forms, Schedules, and Tax Deduction Benefits

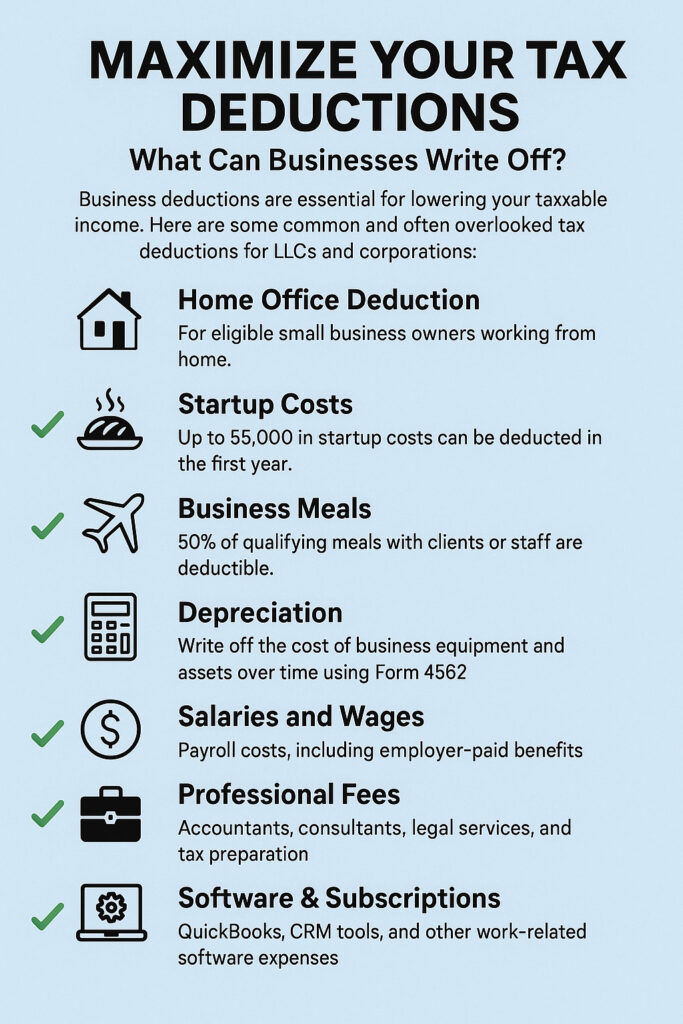

Navigating business taxes in the United States can be complex, especially for corporations and LLCs. Whether you are operating as a single-member LLC, a multi-member LLC, or a C Corporation or S Corporation, it’s essential to understand which tax forms apply, what schedules are required, and how to leverage business tax deductions to reduce your liability legally and effectively.

In this blog, we’ll break down everything you need to know—from required IRS forms to how deductions can be a powerful tool in your financial strategy.

Business Structures & Their Tax Responsibilities

1. Single-Member LLCs (SMLLCs)

By default, a single-member LLC is considered a disregarded entity for federal tax purposes. That means:

The IRS treats it as a sole proprietorship.

You file your business income and expenses on Schedule C (Form 1040).

Other schedules may include Schedule SE (Self-Employment Tax) and Schedule E (if rental income is involved).

Key Form:

✅ Form 1040 + Schedule C

2. Multi-Member LLCs

Multi-member LLCs are treated as partnerships by default. This structure requires:

Filing an informational return on Form 1065 (U.S. Return of Partnership Income).

Issuing Schedule K-1 to each member to report their share of the income, deductions, and credits.

Members include this info on their personal tax return.

Key Forms:

✅ Form 1065 + Schedule K-1 + Individual Form 1040

3. Corporations (C Corp)

C Corporations are taxed as separate entities:

Required to file Form 1120 (U.S. Corporation Income Tax Return).

Can take advantage of a broader range of business deductions.

Subject to double taxation: once at the corporate level and again when dividends are distributed to shareholders.

Key Form:

✅ Form 1120

4. S Corporations

S Corporations pass income, losses, deductions, and credits through to shareholders:

Must file Form 1120-S.

Shareholders receive Schedule K-1 (Form 1120-S).

Key Forms:

✅ Form 1120-S + Schedule K-1

Important Schedules & Tax Forms for Businesses

Here are some of the most commonly used schedules across business structures:

Schedule C – Profit or Loss from Business (used by sole proprietors & SMLLCs)

Schedule K-1 – Partner’s or Shareholder’s share of income, deductions, and credits

Schedule SE – Self-Employment Tax

Form 941 – Employer’s Quarterly Federal Tax Return

Form W-2/W-3 – Employee wage reporting

Form 1099-NEC – Reporting nonemployee compensation (independent contractors)

Why Proper Tax Planning Matters

Failing to understand your filing obligations—or missing key deductions—can lead to costly penalties or overpayment. Here’s why working with a tax professional or enrolling in a reliable tax organization makes a difference:

Stay compliant with state and federal laws

Avoid IRS penalties for late or incorrect filings

Maximize deductions and lower tax liability

Prepare for audits with accurate records

Strategize future tax years efficiently

Final Thoughts

Understanding how LLCs and corporations are taxed, what forms and schedules apply, and how to leverage deductions can make a significant difference in your bottom line.

If you’re unsure where to start or how to optimize your tax filing, partnering with a specialized tax organization can help you stay compliant and financially strategic. Whether you’re a startup or a growing enterprise, having the right guidance ensures your business taxes are filed correctly and efficiently.

👉 Next up: Want to know how to track and categorize your business expenses effectively? Our next blog breaks down how to structure your income and expenses, what counts as deductible, and how to stay audit-ready all year. [Read More on Business Expense Tracking →]